The Ultimate Guide to Using a Secured Credit Card Singapore for Better Financial Management

The Ultimate Guide to Using a Secured Credit Card Singapore for Better Financial Management

Blog Article

Introducing the Possibility: Can Individuals Released From Bankruptcy Acquire Debt Cards?

Recognizing the Influence of Personal Bankruptcy

Bankruptcy can have an extensive influence on one's credit rating rating, making it testing to access credit rating or financings in the future. This financial discolor can remain on credit scores records for numerous years, influencing the individual's capability to protect desirable interest rates or monetary possibilities.

Additionally, personal bankruptcy can limit work chances, as some companies perform credit score checks as part of the working with procedure. This can pose a barrier to individuals seeking new job prospects or occupation improvements. Overall, the impact of bankruptcy extends past economic restraints, influencing different aspects of an individual's life.

Factors Affecting Credit Card Authorization

Complying with bankruptcy, individuals typically have a reduced credit report rating due to the adverse influence of the bankruptcy filing. Debt card firms normally look for a credit score that shows the applicant's capacity to manage credit report sensibly. By meticulously taking into consideration these variables and taking actions to reconstruct credit score post-bankruptcy, people can improve their potential customers of acquiring a credit report card and working towards financial recuperation.

Actions to Reconstruct Credit History After Insolvency

Rebuilding credit scores after insolvency requires a critical method concentrated on economic discipline and constant financial obligation administration. The very first action is to examine your credit rating record to guarantee all financial obligations consisted of in the insolvency are precisely mirrored. It is necessary to establish a spending plan that prioritizes financial obligation repayment and living within your ways. One effective method is to obtain a safe charge card, where you deposit a particular amount as security to establish a credit limitation. Prompt payments on this card can demonstrate accountable credit rating usage to possible lenders. Additionally, think about coming to be an authorized user on a member of the family's credit scores card or discovering credit-builder lendings to additional improve your credit history. It is important to make all settlements on time, as payment history considerably affects your debt rating. Perseverance and perseverance are key as reconstructing debt takes time, yet with commitment to sound economic techniques, it is feasible to enhance your creditworthiness post-bankruptcy.

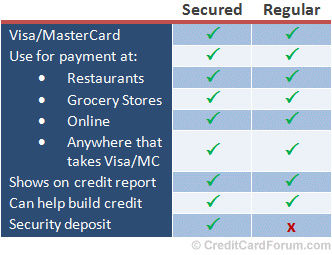

Safe Vs. Unsecured Credit Report Cards

Adhering to insolvency, people typically take into consideration the option in between secured and unprotected charge card as they intend to rebuild their credit reliability and monetary stability. Protected credit rating cards need a cash money deposit that acts as security, usually equivalent to find more information the credit line provided. These cards are easier to acquire post-bankruptcy considering that the down payment minimizes the risk for the company. However, they may have higher charges and rates of interest contrasted to unsecured cards. On the other hand, unsecured charge card do not require a deposit but are more challenging to receive after personal bankruptcy. Issuers assess the applicant's creditworthiness and may offer lower fees and interest rates for those with a good financial standing. When choosing between both, individuals should weigh the benefits of easier approval with secured cards against the potential costs, and think about unsafe cards for their long-term financial goals, as they can aid rebuild credit report without binding funds in a deposit. Ultimately, the selection in why not find out more between protected and unsecured charge card ought to align with the person's monetary objectives and capacity to handle credit scores sensibly.

Resources for People Seeking Credit Score Rebuilding

One useful source for individuals seeking credit report rebuilding is credit report counseling companies. By working with a credit therapist, people can get insights right into their credit rating reports, find out approaches to enhance their credit ratings, and obtain support on managing their finances effectively.

Another valuable source is credit history monitoring solutions. These solutions allow individuals to maintain a close eye on their credit score reports, track any mistakes or changes, and detect possible indications of identity burglary. By checking their credit score on a regular basis, individuals can proactively resolve any type of concerns that may ensure and develop that their credit report information depends on date and precise.

Furthermore, online devices and sources such as credit history simulators, budgeting apps, and monetary literacy sites can offer individuals with beneficial information and tools to assist them in their debt reconstructing trip. secured credit card singapore. By leveraging these sources efficiently, people discharged from insolvency can take purposeful steps towards enhancing their credit health and wellness and safeguarding a better economic future

Conclusion

To conclude, people released from personal bankruptcy might have the possibility to acquire bank card by taking steps to rebuild their credit history. Aspects such as credit history, debt-to-income, and income ratio play a significant role in charge card authorization. By comprehending the effect of personal bankruptcy, picking between protected and unsecured credit history cards, and using sources for credit scores restoring, individuals can improve their credit reliability and possibly acquire access to bank card.

By working with a credit scores counselor, people can get insights right into their debt records, discover strategies to enhance their credit ratings, and get guidance on handling their finances properly. - secured credit card singapore

Report this page